Excitement About Pvm Accounting

10 Easy Facts About Pvm Accounting Explained

Table of ContentsThe Ultimate Guide To Pvm AccountingPvm Accounting - TruthsExamine This Report on Pvm AccountingThe Only Guide to Pvm AccountingThe Best Guide To Pvm AccountingSome Known Incorrect Statements About Pvm Accounting

Manage and take care of the creation and approval of all project-related invoicings to customers to promote excellent interaction and avoid problems. construction accounting. Ensure that appropriate reports and paperwork are sent to and are upgraded with the IRS. Guarantee that the accountancy procedure complies with the law. Apply needed building and construction bookkeeping requirements and treatments to the recording and coverage of construction activity.Understand and preserve basic price codes in the audit system. Interact with numerous financing agencies (i.e. Title Company, Escrow Business) regarding the pay application procedure and requirements needed for repayment. Take care of lien waiver disbursement and collection - https://pubhtml5.com/homepage/ijerc/. Monitor and solve bank problems consisting of fee anomalies and examine differences. Assist with applying and preserving interior financial controls and procedures.

The above declarations are meant to describe the basic nature and degree of work being carried out by individuals appointed to this classification. They are not to be interpreted as an exhaustive checklist of duties, obligations, and abilities required. Personnel might be called for to do tasks outside of their normal responsibilities once in a while, as required.

How Pvm Accounting can Save You Time, Stress, and Money.

Accel is looking for a Construction Accountant for the Chicago Office. The Building and construction Accountant does a selection of bookkeeping, insurance policy compliance, and job management.

Principal obligations include, however are not limited to, taking care of all accounting functions of the business in a prompt and exact manner and offering records and schedules to the business's certified public accountant Firm in the prep work of all economic statements. Makes certain that all accountancy treatments and functions are managed precisely. Accountable for all economic records, pay-roll, banking and everyday operation of the accountancy function.

Functions with Job Managers to prepare and upload all regular monthly billings. Produces monthly Task Expense to Date records and functioning with PMs to reconcile with Task Managers' spending plans for each job.

The Only Guide to Pvm Accounting

Effectiveness in Sage 300 Building And Construction and Genuine Estate (previously Sage Timberline Office) and Procore building and construction administration software application an and also. https://anotepad.com/notes/4hdynf83. Have to likewise excel in various other computer software application systems for the prep work of records, spread sheets and other accounting evaluation that may be required by management. Clean-up bookkeeping. Must have solid business abilities and ability to prioritize

They are the monetary custodians that ensure that building jobs continue to be on budget, adhere to tax guidelines, and keep economic openness. Construction accountants are not just number crunchers; they are tactical partners in the building process. Their key duty is to manage the financial aspects go to this site of construction projects, guaranteeing that resources are assigned effectively and monetary dangers are decreased.

The 10-Minute Rule for Pvm Accounting

They work very closely with task supervisors to create and keep track of budget plans, track costs, and forecast monetary requirements. By keeping a limited grasp on task funds, accounting professionals help protect against overspending and monetary troubles. Budgeting is a keystone of successful construction jobs, and construction accounting professionals are critical in this regard. They develop in-depth budgets that incorporate all job expenditures, from products and labor to permits and insurance policy.

Building and construction accountants are skilled in these regulations and make certain that the project complies with all tax demands. To excel in the function of a building accounting professional, people need a solid instructional structure in accounting and financing.

Furthermore, certifications such as Qualified Public Accounting Professional (CERTIFIED PUBLIC ACCOUNTANT) or Qualified Building And Construction Sector Financial Specialist (CCIFP) are very regarded in the sector. Functioning as an accounting professional in the building and construction sector includes an one-of-a-kind collection of difficulties. Building and construction jobs usually entail limited due dates, altering guidelines, and unforeseen expenses. Accountants must adapt quickly to these obstacles to maintain the job's monetary health and wellness intact.

The Best Strategy To Use For Pvm Accounting

Specialist qualifications like certified public accountant or CCIFP are likewise extremely recommended to demonstrate knowledge in construction accounting. Ans: Building and construction accounting professionals produce and keep track of budgets, identifying cost-saving possibilities and making sure that the project remains within budget plan. They also track expenses and projection monetary needs to avoid overspending. Ans: Yes, building and construction accountants manage tax obligation compliance for building and construction jobs.

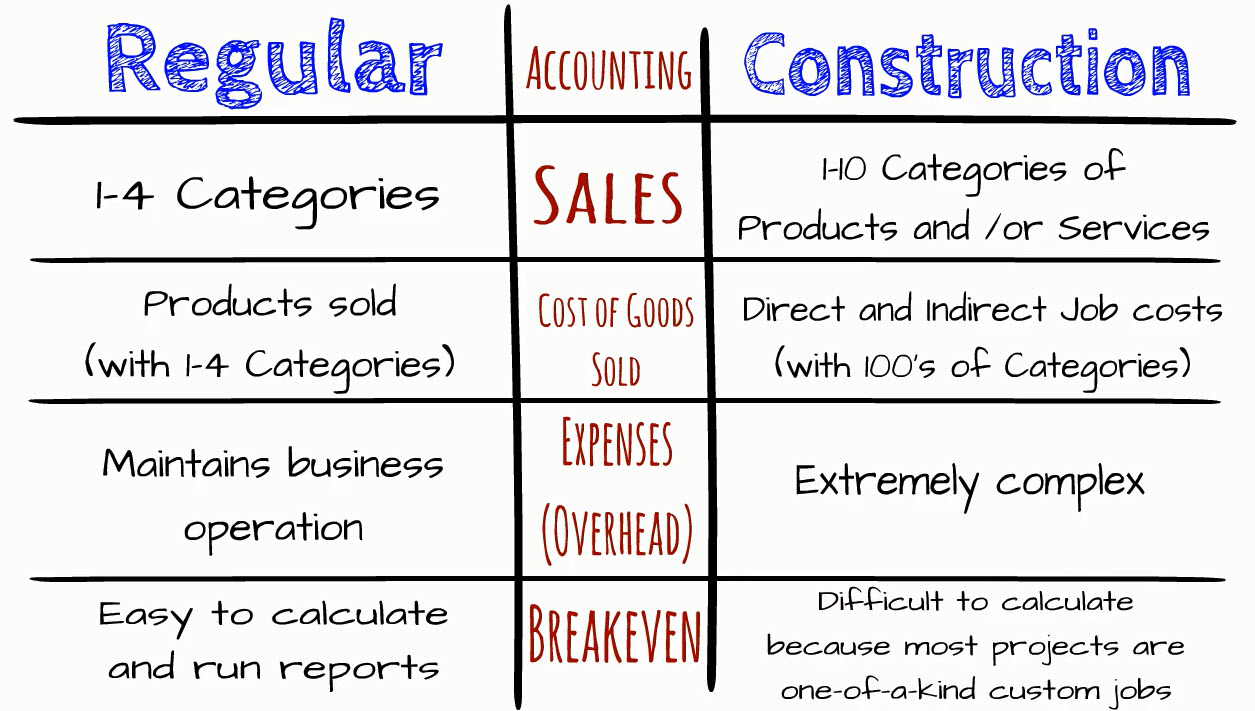

Introduction to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies need to make tough choices amongst numerous economic options, like bidding on one task over one more, picking funding for products or devices, or setting a task's revenue margin. Building is a notoriously unstable market with a high failure rate, sluggish time to repayment, and inconsistent cash flow.

Production entails repeated processes with conveniently identifiable costs. Manufacturing needs different procedures, materials, and equipment with differing expenses. Each task takes location in a brand-new location with differing site conditions and one-of-a-kind obstacles.

All About Pvm Accounting

Regular use of different specialty contractors and suppliers influences performance and money flow. Payment gets here in complete or with routine payments for the complete agreement amount. Some section of repayment may be withheld till job completion also when the specialist's work is completed.

Regular manufacturing and short-term contracts bring about workable capital cycles. Uneven. Retainage, slow settlements, and high in advance costs lead to long, uneven capital cycles - construction taxes. While traditional suppliers have the benefit of controlled settings and enhanced production procedures, building companies have to frequently adapt to each new job. Even rather repeatable projects require modifications as a result of website conditions and various other variables.